corporate strategiesin bond debt financing

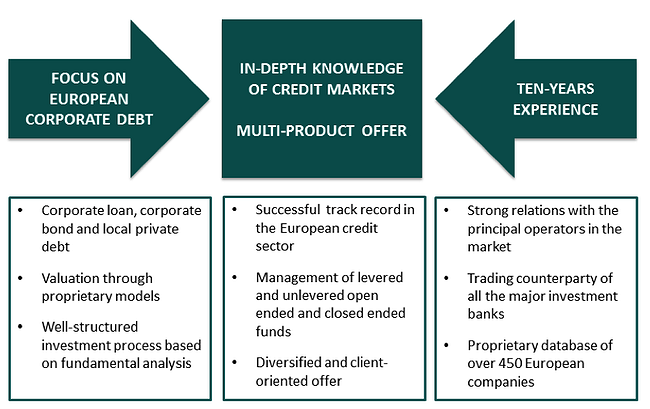

Our Debt Finance practice represents borrowers private equity sponsors and lenders in a broad range of financing transactions. WHAT ARE CORPORATE BONDS.

Senior Debt Vs Corporate Bonds Debt Comparison

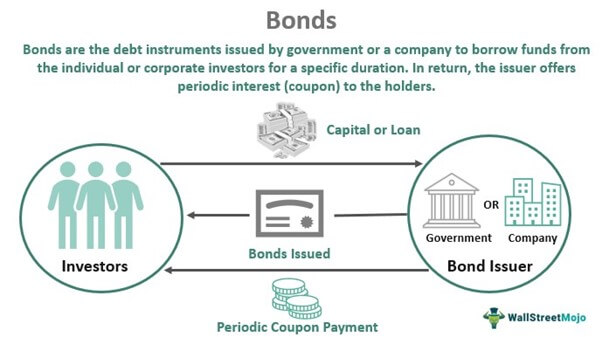

When you buy a corpo-rate bond you essentially lend money to the entity that issued it.

. A corporate bond is a fixed-income instrument issued by a corporation. Today 19 percent of total global corporate debt is in the form of bonds nearly double the share in 2007. Is working to slash its debt and is considering its options for 15 billion in maturities that.

Average yields of 8-10 can be expected from corporate debt instruments while government-held bonds only provide approximately half of it. CHFFA BOND FINANCING PROGRAM EXECUTIVE SUMMARY Applicant. Today nearly 20 percent of total global corporate debt is in the form of bonds nearly double the share in 2007.

Often yield curves plot the yields on coupon bonds against maturities but in its purest form the yield curve should reflect the rate of return earned on zero-coupon bonds of the specific maturity. Introduced in July of 2002 TRACE consolidates transaction data for all eligible corporate bonds - investment grade high yield and convertible debt. Our Debt Finance lawyers work closely with the firms Private Equity Technology Companies Capital Markets and Financial Restructuring groups structuring negotiating and documenting domestic and cross-border debt.

Corporate bonds typically refer to long-term debt instruments that possess a maturity date at least a year after the date in which they are issued. Global corporate bond markets have expanded but risks are rising in the bull market. Former Federal Reserve Chair Janet.

The ratio has risen in 33 of the 52 countries it. These 1991 CHFFA bonds were used. Sheet displays strong ability to repay debt with positive net assets and a pro-forma debt service.

TRACE OTC Corporate Bond and Agency Debt Bond Transaction Data Trade Reporting and Compliance Engine NASDs over-the-counter OTC corporate bond market real-time price dissemination service. Tax system treats debt financing and equity financing differently. This is one of the first attempts to consider the determinants of financing choices including syndicated loans as a separate asset class and a direct competitor to corporate bond financing.

The investor receives regular interest payments from the issuer. Typically a corporate issuer will enlist the help of an investment bank to underwrite and market the bond offering to investors. In this way a.

A bank loan is a financial operation in which a banking entity lender through a contract or agreement between the parties involved grants a sum of money to a third party borrower in exchange for the payment of interest known as the cost of moneyA bond by contrast is defined as a debt instrument issued by a company or public administration and sold. The issuer is the participant most likely to be called upon to provide information and coordinate a workout strategy. In return for the loan of your funds the issuer agrees to pay you interest and to return.

Corporations use this money for a variety of purposes like expanding a business capital improvements new facilities etc. A corporation will issue a corporate bond to raise money to help fund its specific business ventures. Yield curve can be created for any segment of the marketfrom treasury debt to AAA corporate debt to non-investment grade corporate debt.

The main advantages of investing in corporate bond funds are Higher returns. Because of this throughout the debt financing process the issuer should. Our experienced team administers a wide range of trust and agency appointments provides expert insight into new market trends and serves as trustee andor paying agent on.

In sectors where heavy investment spending Capex is necessary Utilities Telecoms corporate hybrid bonds serve to finance long-term investments without deteriorating the issuers financial profile. In debt financing a business raises money by issuing debt usually by. 16 2022 730 am ET.

Global corporate debt excluding financial firms has risen from 84 of GDP in 2009 to 92 in 2019 reckons the Institute of International Finance. Been growth in nonfinancial corporate debt which is nearly as big. Corporate bonds are a form of debt financing where debt obligations IOUs are issued by corporations and sold to investors.

Features and benefits of corporate bond funds. Bonds a tax audit that reveals irregularities or an investigation by a regulatory agency. Corporate bonds also called corporates are debt obligations or IOUs issued by privately- and publicly-owned corporations.

Raising funds directly via the corporate bond market. 1 hour agoVerizon Communications hit the market on Wednesday with a new 30-year corporate debt financing that will add to its arsenal of green bonds that show investors how funds have been used. Corporate bond funds ensure significantly higher returns than other debt instruments in the market.

Corporate debt loads in a broader perspective the total amount has surpassed 9 trillion and equals more than 45 of annual US. Since the crisis many large corporations around the world have shifted toward bond financing as commercial bank lending has been subdued. Off Good Samaritans outstanding 1991 CHFFA bonds and for other general corporate purposes.

Since the financial crisis many large corporations around the world have shifted toward bond financing because commercial bank lending has been subdued. Corporate Bonds Whether you need basic trustee services or access to a wide range of value-added services we have the resources and expertise to help you execute your debt financing strategies. Today hybrids are mainly used for refinancing purposes by issuers who wish to stabilise their financial profile and prevent a rating downgrade.

Bonds can be classified according to their maturity which is the date when the company has to pay back the. Companies use the proceeds from bond sales for a wide variety of purposes including buying new equipment investing in research and development buying back their own stock paying shareholder dividends refinancing debt and financing mergers and acquisitions.

My Barbell Strategy Emergency Fund Investing Personal Finance

Stock Market Vs Bond Market What S The Difference Investing Strategy Personal Financial Planning Stock Market

What Is A Bond A Great Infographic From Mint Com Finance Investing Investing Money Management

Bayer Investor Relations Bonds Financial Strategy Net Financial Debt Financial Strategies Bond Investor Relations

Debt Finance For Businesses Financial Economics Tutor2u

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

0 Response to "corporate strategiesin bond debt financing"

Post a Comment